Personal Financial App

Since the pandemic, Millennials and Generation Z have experienced financial difficulties, and their interest in finance has increased. It is a service that prevents the preconceived notion that 'finance is difficult' that millennials and Generation Z have, and helps them manage their financial assets.

Our main target audiences are Millennials and Generation Z who are unfamiliar with or interested in financial management.

Research

Survey

User Interview

Persona

Information Architecture

Information Architecture

Sketching

Design

Visual Design

Prototype

Usability Testing

User Feedback

Evaluation

.png)

.png)

.png)

.png)

I am interested in asset management and finance, but it seems too difficult.

I want to develop a habit of planned spend.

I have no idea how to manage my money.

I do a lot of impulse buying to change my mood.

Millennials and Generation Z who are unfamiliar with'asset management' and 'investment'

Millennials and Generation Z, who have been pursuing YOLO (you only live once), want to engage in financial activities for a stable future due to social issues such as pandemics.

However, we can see the situation of millennials and Generation Z who feel a barrier to wealth management and financial activities and give up due to unfamiliar and difficult financial terms and knowledge.

Millennials and Generation Z's attempts to improve spending awareness and habit

The percentage of respondents concerned about overall spending activity was high. They are actively accepting various attempts such as opening a saving account and checking their transaction history to improve their consumption habits, and are showing a lot of interest in services that manage their spending patterns and assets.

Millennials and Gen Z who consume depending on their emotions

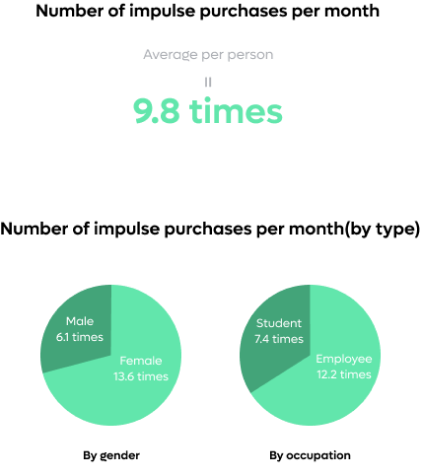

It was confirmed that, on average, 9.8 times per person for a month, impulsive purchases were frequent for an immediate change of mood. However, most of the opinions were that there was not much regret. It shows a tendency to consciously rationalize such irrational consumption.

Feel a barrier to wealth management and financial activities

Want to improve consumption habits

Frequent impulse buying

Provide financial knowledge and news

Can check all financial activities including subscriptions and provide financial report

Manage expenses by entering expected schedule and expenses